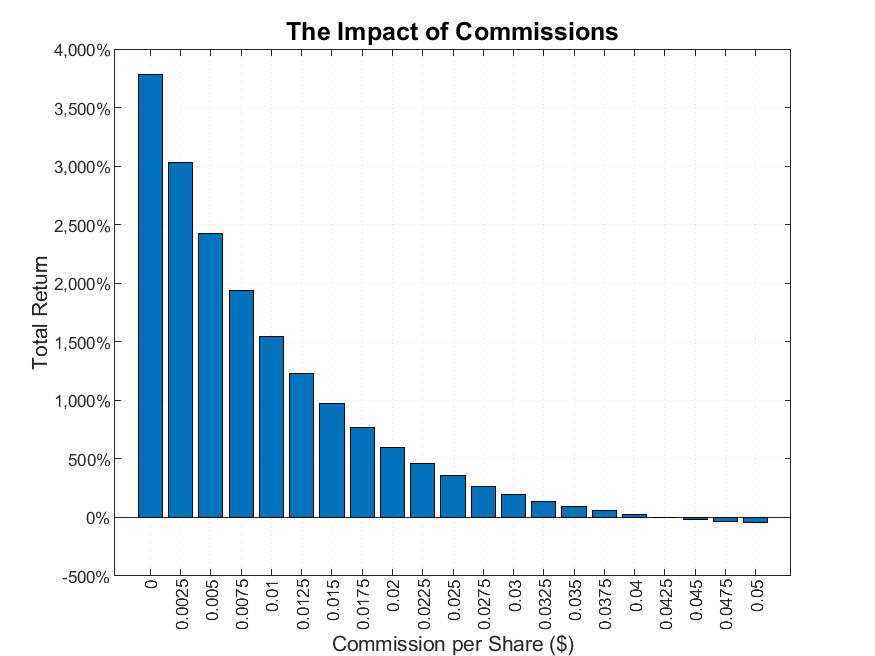

To effectively evaluate the impact of slippage on a trading strategy, the most reliable method involves placing real market orders and comparing the execution prices against a reference price. Yesterday, we executed over 350 random market orders on SPY, with transactions exceeding $30 million in notional value. This test was carried out using a newly opened Interactive Broker account with an initial funding of $100k, under the entry-level broker commission structure ($0.0035 per share). All the trades were sent few milliseconds before the start of a new minute. We assessed the execution price against the most recent bid/ask prices—commonly known as NBBO—and versus the opening price of the next 1m candle. Here are the findings: The average slippage compared to the NBBO was $0.0009, whereas the slippage against the opening price of the next bar stood at $0.0011. Regarding commissions, the average fee per share for a BUY order was $0.0036, while for SELL orders, it was $0.0081. The higher cost for SELL orders is attributed to Regulatory Fees, which are only applied to sales. This study aimed to determine whether an intraday strategy on SPY, recently devised for a client, would remain profitable after considering commissions and slippage. The analysis reveals that commission and slippage costs, albeit present and a significant drag, do not erode the overall profitability of the strategy.