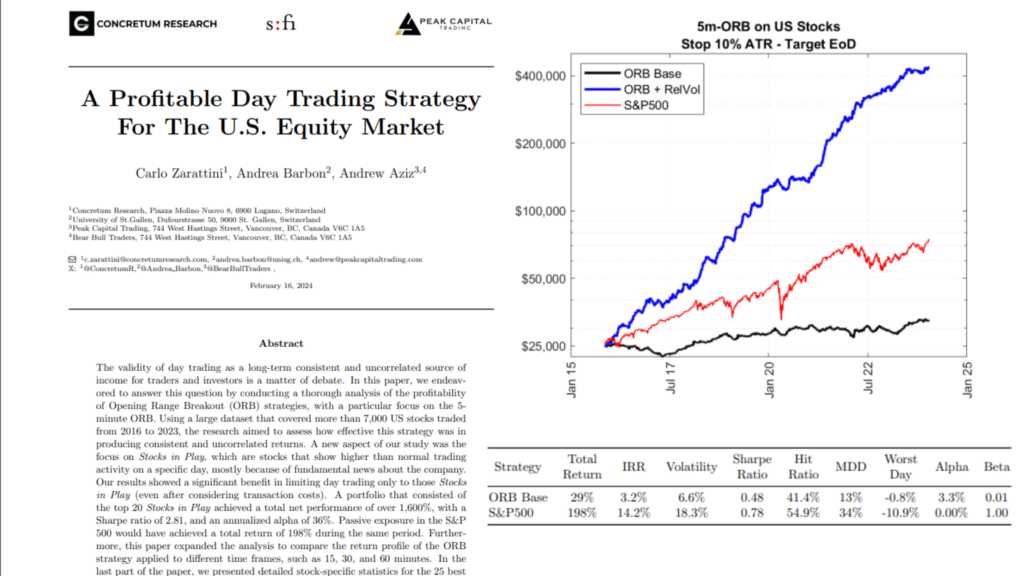

This study assesses the 5-minute Opening Range Breakout (ORB) strategy for day trading, analyzing over 7,000 US stocks from 2016 to 2023. It highlights a 1,600% net gain and a Sharpe ratio of 2.81 with high-activity stocks, offering a novel insight into specific intraday stock performance.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4678427

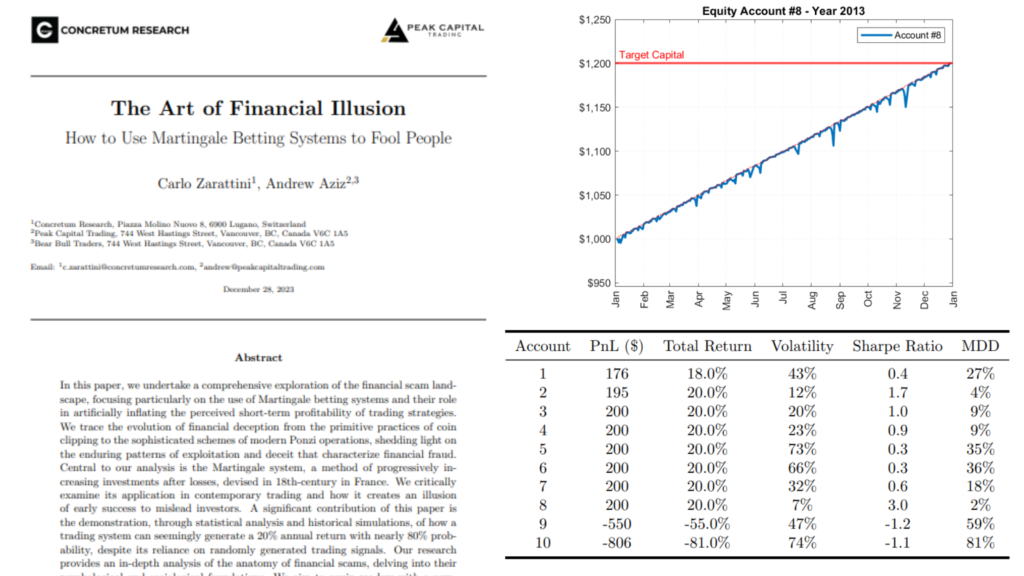

This paper explores the use of the Martingale system in financial scams, tracing the evolution of fraud from coin clipping to Ponzi schemes. It uses statistical analysis to show how these scams falsely promise high returns, aiming to help investors and regulators recognize and prevent such tactics.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4678427

This paper examines a VWAP-based day trading strategy using QQQ and TQQQ from January 2018 to September 2023. It demonstrates how this strategy significantly outperforms the passive buy-and-hold approach, turning a $25,000 investment into $192,656 with QQQ and $2,085,417 with TQQQ. The strategy shows robust returns with lower risk, illustrating VWAP’s effectiveness in diverse market conditions.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4631351

This paper analyzes the Opening Range Breakout (ORB) strategy in day trading from 2016 to 2023, including during volatile market conditions. It compares the performance of an ORB strategy using QQQ and leveraged ETFs like TQQQ against a passive QQQ investment. Results show that the ORB strategy, even with leverage constraints, significantly outperformed passive investing, yielding a 1,484% return compared to 169% for QQQ, demonstrating its potential for high returns in day trading.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4416622